Our partners

Why care?

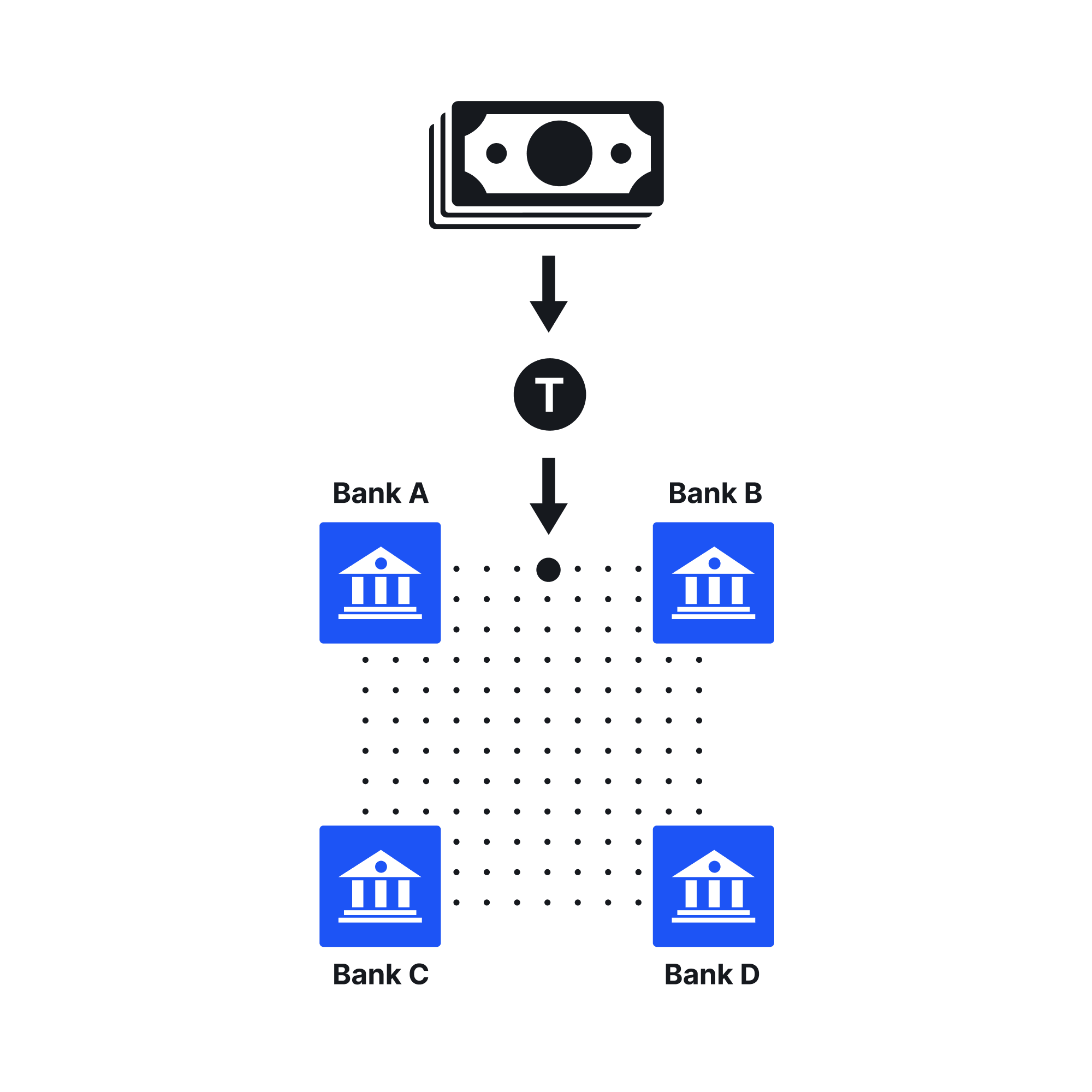

As the world of finance gets tokenized, we can’t have as many non-fungible assets as there are financial institutions, if they're to be used for payments. Whether tokens are issued by central banks, commercial banks, or other regulated financial institutions, they need to be fungible. We’re focused on the tokenization of regulated liabilities. We call them Tokenized Regulated Liabilities, or TRLs for short.

A GBP coin issued by the Bank of England should be fungible with a GBP coin issued by Barclays. Just like today!

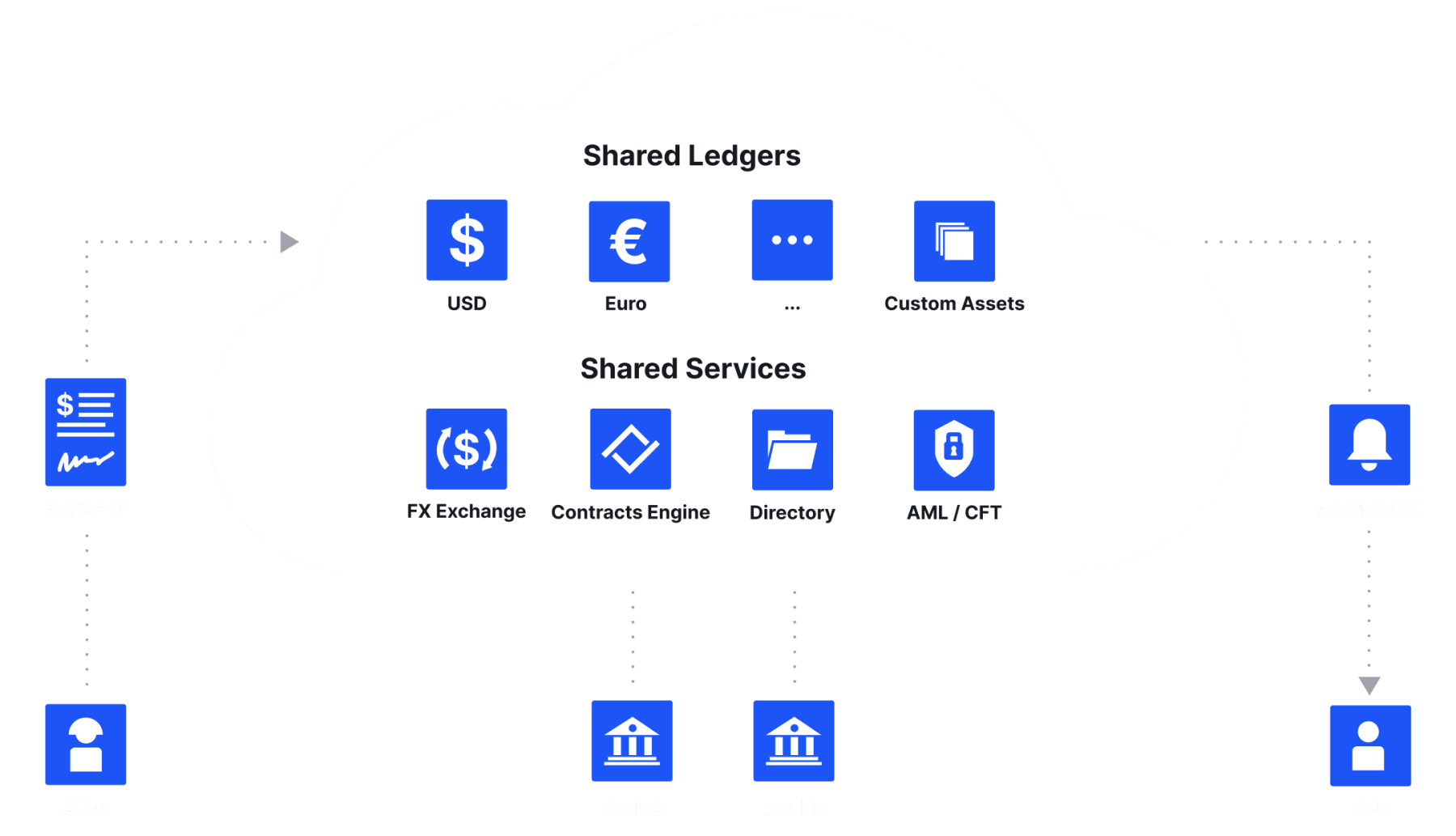

The cloud-based digital

native currency platform

M10 is delivered to banks as a cloud-based service and includes shared ledgers, and other shared services such as directory service, FX service, compliance tools and more. Combined, they offer:

Tokenization of regulated liabilities

Instant transfer and settlement of TRLs

Programming of TRL payments

Compliance with existing rules and regulations

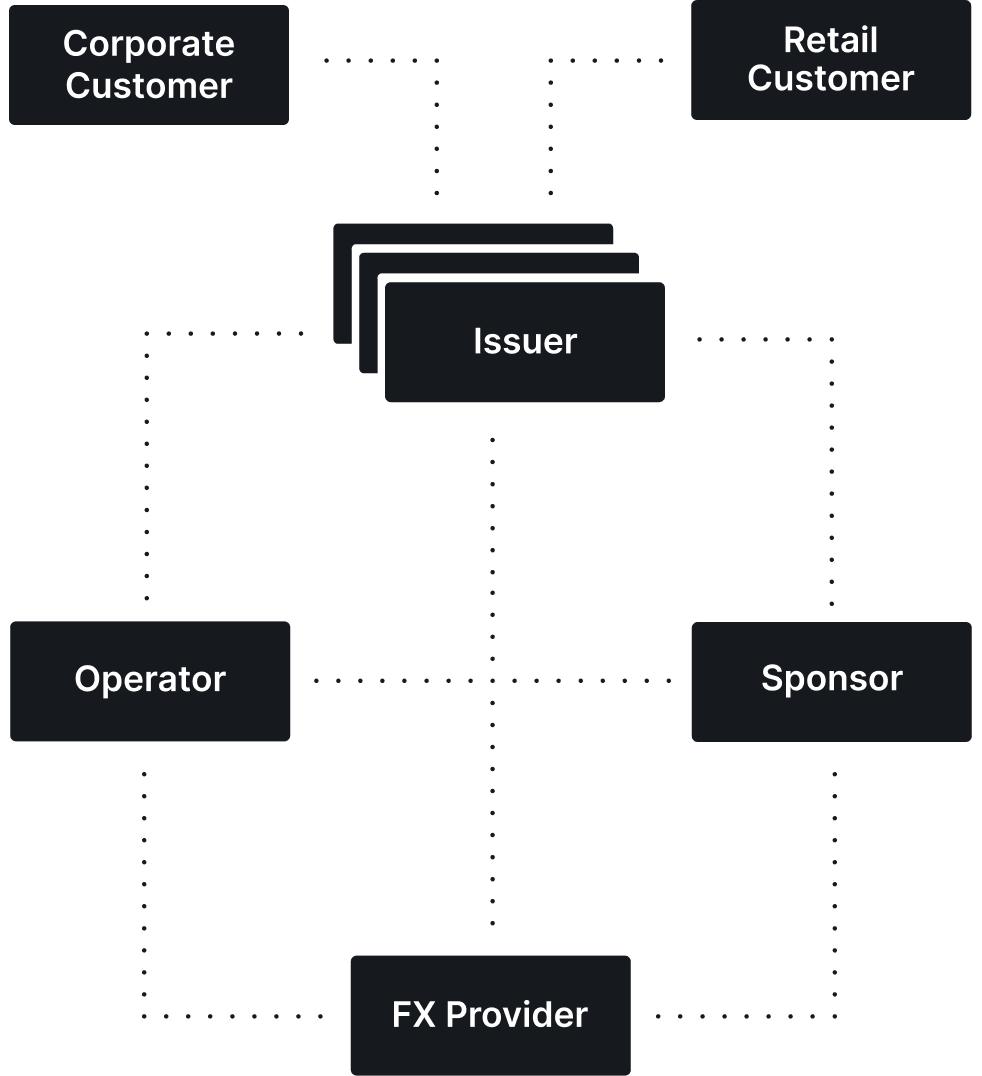

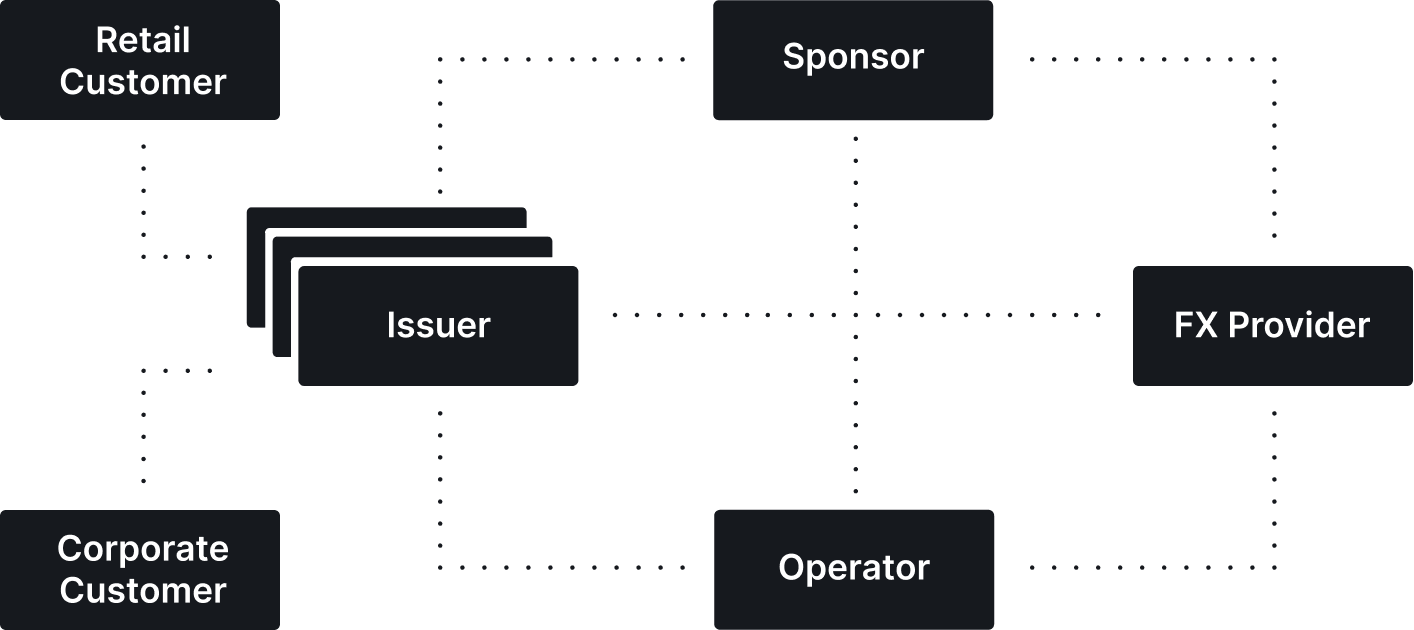

The M10 ecosystem

-

OperatorRuns and operates the M10 network in a country, or region.

-

IssuerThe regulated financial institution issuing digital currency in the form of TRLs to its customers.

-

SponsorOnboards banks and hold collaterals backing the Tokenized Regulated Liabilities.

-

FX ProviderProvides FX for the Issuers. Brings liquidity in multiple currencies.

Use cases

for digital currency network

Any payments use case that benefits from instant, low-cost, 24x7 transfers. For commercial banks that includes:

Retail remittances

International trade finance

Cross-border disbursements

Cross-border merchant payment processing

-

DvP/PvPGuaranteed transfer of securities (DvP), or currency (PvP) at the time of payment

-

Treasury managementCorporate treasurer managing the company’s cash

-

dAppsDecentralized apps – applications without an intermediary such as a bank

For central banks the use cases include:

-

RTGS modernization

Efficient operations of a country’s RTGS -

CBDC (wholesale and retail)

Central Bank Digital Currency for use by retail customers and banks for inter-bank settlement.

Want to learn more?

We love hearing from you! Give us a little detail here, and we'll get back to you shortly.